An investment in knowledge pays the best interest.

– Benjamin Franklin

Anticipated Impact of Recession on RV Parks

We don’t know if the next recession will be a hard landing or a soft landing, and candidly, we don’t totally care. There is a prevailing expectation among economists that the United States will face an economic recession, possibly later this year or in 2024. While there’s no way to be absolutely certain how the economy will land, I share this viewpoint and believe that most asset markets have not yet reached their low point. Despite these negative sentiments, I maintain a positive outlook on both entry-level housing and RV parks. While I have previously presented arguments for affordable housing, I would like to outline the case for RV parks.

Why am I still bullish on RV parks? In this discussion, we will explore the implications of a recession on RV parks, drawing insights from basic observations, historical data, and experiences during the Great Recession of 2007/2008. The first question to address is whether RV parks are considered a luxury or a necessity, as these are the two categories that typically thrive during economic downturns in America. During challenging times, people tend to prioritize purchasing essential items and indulge in personal vices such as food, liquor, and in some states like Colorado, cannabis.

If we consider that, during times of peril, individuals gravitate towards things they need and a few things they truly love, where does the RV park industry fit in? Well, it falls into both categories. One group of people use their RV as a form of primary, year-round housing. In the next recession, some individuals who cannot afford their homes or who want to sell and capture equity to float a difficult economic environment, may choose to sell and live in their RVs, permanently. This highlights the necessity aspect. Flip the coin, and there is also a significant number of people who love RV travel, including, baby boomers, gen x’ers and millennials. People who already own RVs will not abandon their two weeks of vacation, even in a recessionary period. In fact, it’s more likely the “Eurotrip” gets cancelled in favor of the staycation or weekend trip to the local reservoir. A 2018 study conducted by CBRE Hotels Advisory Group determined that RV vacations are, on average, 27% – 62% less expensive on a per day basis than traditional travel vacations that incorporate airfare, a rental car and lodging. As a result of enduring demand, the RV industry has consistently witnessed high sales volumes, even in recessionary periods.

Now, let’s consider RV sales. It is important to note that there is a disconnect between RV sales and the RV park industry. There are already enough RVs on the road to fill virtually every RV park. However, increasing sales contribute to greater demand, leading to higher occupancy rates and rents. Although RV sales may decrease during a recession, it is unlikely to have a substantial impact on the RV park industry. Even if sales declined significantly, the existing number of RVs would suffice to fill available RV park spaces. Therefore, the industry’s reliance on new RV sales is relatively minimal.

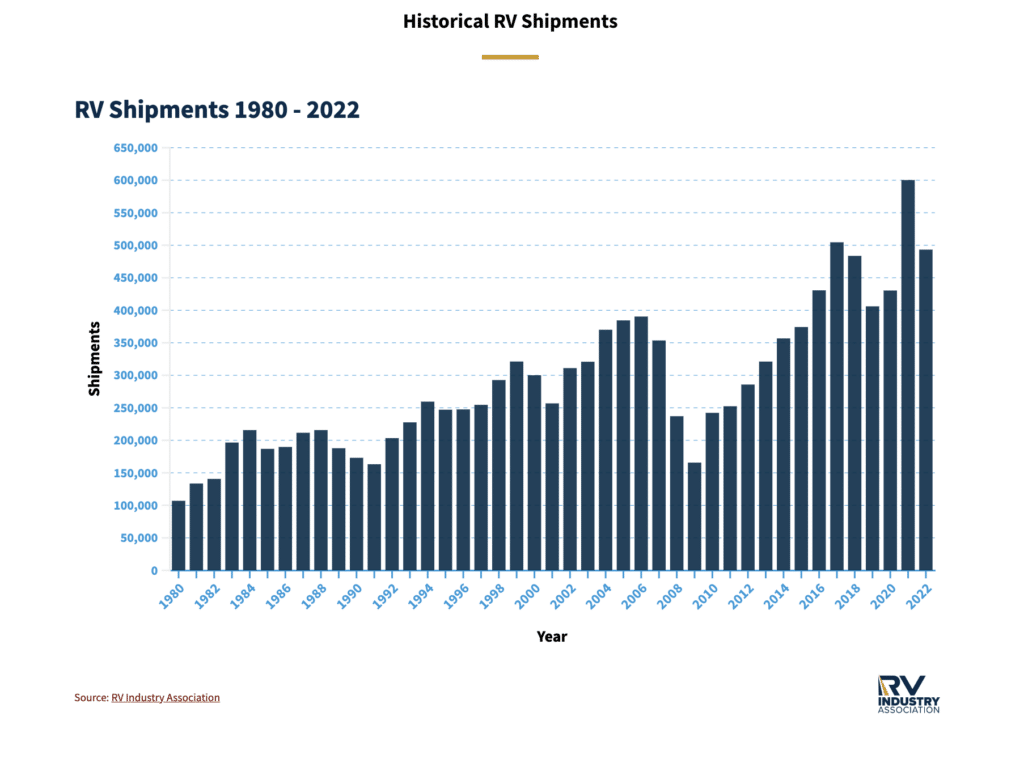

Historical RV Shipments: Provided by RV Industry Association. Source. *RV sales have grown consistently over the past decade. Even among the challenges posed by the COVID-19 pandemic in 2020, RV shipments reached their highest annual total in 40 years, totaling 430,412 units.

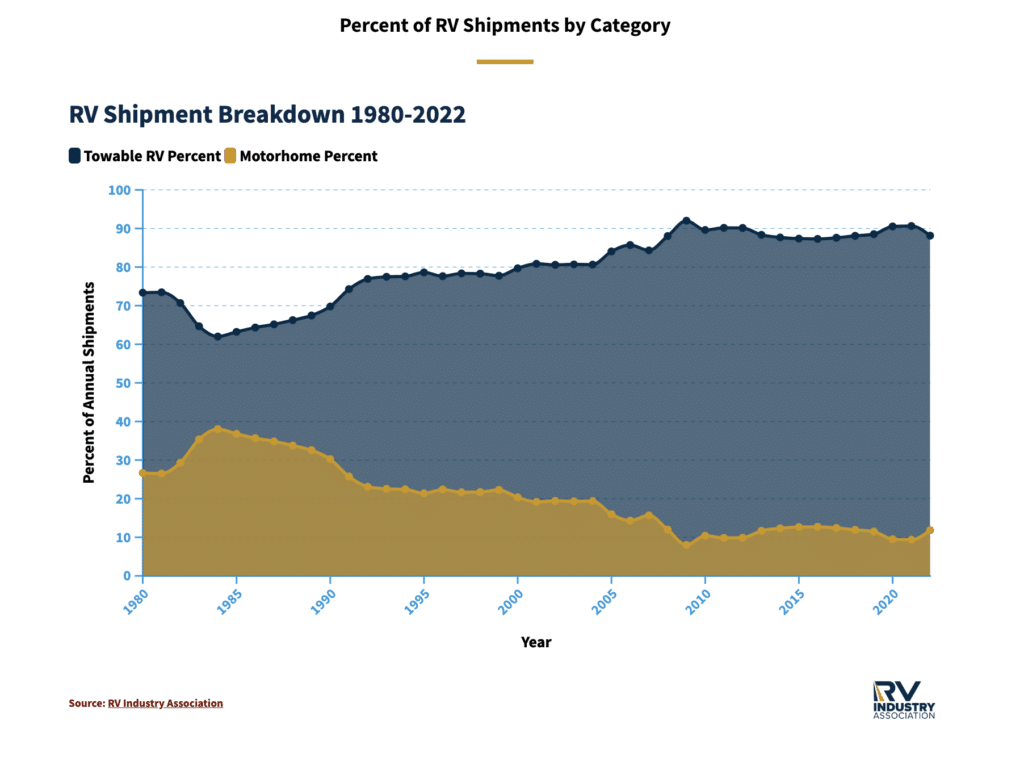

Historical RV Shipments by Type: Provided by RV Industry Association. Source.

RV Parks Roll Over the Recessionary Storm

Additionally, the banking sector may experience some changes during a recession. Banks typically exhibit a flight to quality, preferring to finance deals they consider safer. Consequently, they may be less enthusiastic about financing RV park development deals compared to well-established RV parks that are already performing well. However, certain government agencies continue to offer loans for RV park investments, and conduit lenders and banks will still be active in making loans. While there may be a shift in the desired lending criteria, banking will adapt to the new economic environment.

During a recession, interest rates tend to decrease significantly. This reduction in interest rates will impact both banking and capitalization rates for property purchases. Historical data suggests that interest rates typically fall an average of 2.5 points from the start to the end of a recession (since 1950). If we look at Fed guidance, we likely have another 0.50% increase coming in this year before rates stabilize, which would place rates in the 5.5% range. If interest rates decline by this amount, it would still result in manageable rates. If RV Park owners purchased their properties at higher cap rates before the decline in interest rates, they would enjoy built-in profitability due to this factor alone. To be clear, I do not endorse this as an investment strategy, but it is relevant. In our investments, the firm wants to buy assets that can force appreciation via development or value-add rather than gambling on interest rates. But I’d happily take it.

Looking back at the Great Recession of 2007 & 2008, the RV park industry performed remarkably well. Prior to that period, it was relatively untested, i.e., how RVs and RV parks would fare in times of economic hardship, given the substantial increase in RV purchases since the previous major recession. Although RV manufacturing fell to under 200,000 units during the period, RV park occupancy remained robust. Similarly in 2021, amidst COVID-19-related pressures, very few RV parks defaulted or went to auction (to the best of my knowledge). In fact, the only that I know of was River Dance, and I bought it. This indicates that RVs and RV park usage are considered both a necessity and a nice-to-have. Some people choose RV living due to affordability, while others simply enjoy the experience in any economic environment. This observation is foundational to Fortius Capital’s acquisition, investment, and development strategy.

To bring it all together, the RV park industry is expected to weather an upcoming national recession, largely unscathed. Lower interest rates will eventually benefit all real estate sectors, and as weaker players in other industries falter, stronger sectors like RV parks will likely garner increased attention from lenders and investors, potentially driving up their value.

Don’t be surprised when you see upcoming investment opportunities from us that include additional RV Parks in high barrier to entry markets.

Here’s to capitalizing new vehicles that weather the storm….

Best,

Mike Pearson

President