Consumers are Bleeding

The COVID-19 pandemic followed by the Ukraine War has thrown the global economy into a tailspin. Globally, businesses and consumers are experiencing high blood pressure, as the cost of doing business and living have increased at an alarming rate without relative growth in national wages or GDP.

The time to prepare for a distressed cycle is now.

– Mike Pearson

Consumerism or BUST

Consumers are getting hammered in a consumer-driven economy.

- GDP in the first quarter of this year was -1.5%…

- Inflation is at 40 year highs….

- And, wage growth is not keeping up with increasing costs of living…

In the United States, Consumer Spending accounts for nearly 70% of the Gross Domestic Product (GDP). That means, shopping in the United States trumps just about all other economic activity. When the consumer is healthy, generally, the economy will keep on chugging. Unfortunately, several indicators are demonstrating that consumers are not doing well, and it’s likely to get worse before it gets better. For a growing number of people, the most foundational human needs could go unmet as a worldwide recession takes center stage.

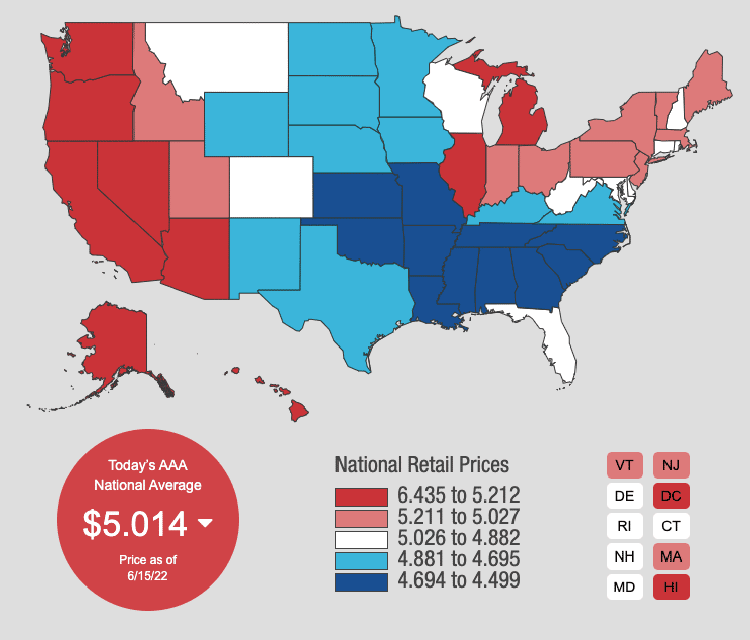

Pain at the Pump

According to AAA, the national pricing average, per gallon, of regular gasoline sits at a staggering $4.955 (up 62% since June 2021), while a gallon of diesel is setting consumers back $5.719 (up 56% since June 2021). The state average for a gallon of gas in Colorado sits at $4.77, so I am just glad I don’t live in California where the state average is currently $6.39 per gallon. In the long run, high prices are cured by high prices, but there doesn’t appear to be any relief on the horizon, as even the World Bank reports many countries are heading toward a recession, warning of a possible 1970’s stagflation blanket over the global economy. Back-to-back blows from the COVID-19 pandemic, and now Russia’s war with Ukraine has, once again, placed the global economy in danger. World Bank president, David Malpass, states the global economy could be potentially threatened by, “several years of above-average inflation and below-average growth are now likely, with potentially destabilizing consequences for low- and middle-income economies. It’s a phenomenon—stagflation—that the world has not seen since the 1970s.”

Cost of Shelter

Housing is the least affordable it has been in at least a generation. You can look at housing from several different data points. Some indicators suggest the US housing affordability matrix is not that bad, but not a single indicator, regardless of how you try and spin it, would show housing affordability was within tangible reach for the vast majority. In my opinion, the most accurate indicator of housing affordability is the Home Ownership Affordability Monitor (HOAM) published by the Federal Reserve Bank of Atlanta. This index contemplates income, interest rates and housing prices. As you can see, it’s not pretty right now…

Food for Thought

I realize I’m stating what is already felt and known, as we’re all buying groceries (at a 10%+ mark-up, it seems), but I want to make sure I put this into plain perspective for everyone. Food prices are increasing rapidly, and pricing is likely to get worse before it gets better. Most talking heads on CNBC are quoting CPI print, which also doesn’t look good. Don’t forget, CPI does not include food, shelter, or fuel, which represent a consumers’ true Maslow’s Hierarchy, i.e., the three most crucial goods every consumer MUST purchase to simply survive. According to the U.S. Bureau of Labor Statistics, food prices have increased 9.4% year over year.

source: tradingeconomics.com

Savings & Credit

When times get tough, consumers must rely on savings. The economy prays that folks have something in the piggy bank to draw down from and lessen the impact during times of shortage. While the U.S. Personal Savings Rate did see a substantial increase during the pandemic, mostly because of “stimmy checks”, the rate of savings continues to swan dive (especially, considering the widespread inflationary effects and price sensitivities). Without any savings (or, rapidly dwindling savings), a consumer is required to take on additional credit (debt) to prevail. However, not only has the savings rate continued to plunge, according to Federal Reserve Data, but Revolving Credit (credit card) balances are exploding. This is highly discouraging, considering the economy hasn’t even, technically, entered a recession YET.

National Wages

Lately, we have heard a lot of positive spin that while inflation is higher, unemployment is lower, and wages continue to increase. Wages are increasing, and maybe they continue to accelerate, but I am not sure how that happens or maintains with negative economic growth. To add insult to injury, when you adjust wages for inflation, wage growth is actually negative, according to the Federal Reserve.

Final Thoughts

We live in an economy that is largely driven by consumer spending. Yet, consumers are experiencing:

- Negative real wage growth…

- Pain at the pump…

- Housing is massively unaffordable…

- Food prices are climbing…

- Stress due to very little savings…

- Revolving credit inversely climbing as savings dwindle…

Clearly, average consumers are in trouble. This could create a ripple effect on the global economy, meaning more drag and lag in productivity and spending. An analogy that makes sense to me is “Recessionary Ripples”, or the long-standing effect of an economy feeling recessionary effects in waves, each wave stronger than the last. Regardless of what color lipstick we put on the pig, we’re likely already in a recession that is just getting started, in my opinion. As these ripples continue to move outward through the global economy, even talking heads will start to paint a less optimistic picture. And, as I’ve said, when they do start talking, I’ll hope you’ve heeded my advice and held on to some cash. We believe there is a high probability that a distressed cycle in real estate assets is on the horizon. The Fortius Platform was designed to thrive in such an economic environment, leading with the team and wherewithal required to capitalize on opportunity, even in the harshest economic conditions. We intend on prevailing the storm; ready the moment a distressed opportunity presents itself. As projects materialize, our Fortius Partners will hear the narrative and see the opportunity, first.

Here’s to weathering the storm….

Best,

Mike Pearson

President