Year in Review & the Road Ahead

As we bid farewell to 2024 and step cautiously into 2025, I’d like to take a moment to share Fortius’ outlook for the coming year and what it likely means for the real estate landscape in Colorado’s mountain markets.

Reflecting on 2024

This past year was characterized by a resilient real estate market in Colorado’s resort and mountain regions, despite broader economic headwinds. Demand for luxury and second homes remained steady, driven by high-net-worth individuals seeking lifestyle-oriented investments. Additionally, the ongoing appeal of mountain living bolstered short-term rental performance, particularly in markets like Vail, Aspen, and Breckenridge.

Interest rate volatility created a more cautious lending environment, but this also led to an increase in creative financing opportunities. Many of our projects benefited from strategic value-add initiatives, and we’re proud of the successes we achieved through collaboration and disciplined management. Muddy Creek Cabins was a great example of utilizing seller carry to lower risk and cost of capital for the partnership. Now that all units have been delivered at Muddy Creek, we have a stabilized project that should provide additional optionality when we look to refinance into permanent debt.

We didn’t find many compelling deals in 2024, and while I am hopeful that will change in 2025, I refuse to stretch for assets that I am not confident in. I am not a sponsor that will ever make an investment betting on lower interest rates or speculating on outsized rent growth. I like to find assets that I view as undervalued or mispriced, and where I am convinced that my team can drive the appreciation of the asset. That’s exactly what we did in 2024 and that’s where our focus will remain in 2025.

Inflation is always and everywhere a monetary phenomenon.

– Milton Friedman

2025 Outlook: Challenges and Opportunities

Economic Environment

While inflationary pressures have eased, interest rates are likely to remain elevated compared to historical norms. This environment will reward disciplined operators who can navigate higher borrowing costs and leverage operational efficiencies. For buyers, cash remains king, and we anticipate an increase in off-market deals as sellers adjust expectations.

Demand for Mountain Properties

The allure of Colorado’s mountain markets remains strong. Buyers continue to prioritize lifestyle-driven investments, with many viewing mountain homes as both a retreat and a hedge against urban market volatility. However, affordability challenges could limit the entry-level and mid-tier segments, further cementing the luxury market as the dominant force.

Inflation Makes a Comeback

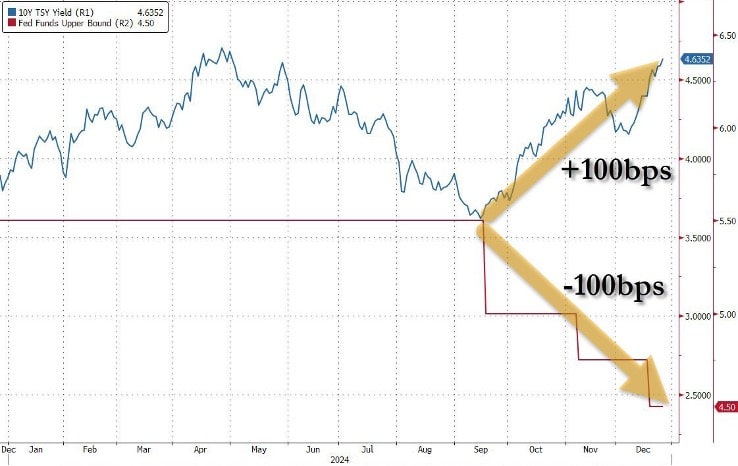

Inflation may have eased in 2024, but I think we will likely see a significant resurgence in 2025. The treasury market seems to agree, considering the Fed has already cut the window rate by 100 basis points while the 10-year treasury rate continues to climb.

As economist Milton Friedman famously said, “Inflation is always and everywhere a monetary phenomenon.” If you want to truly understand inflation, follow the money supply. Money supply continues to grow faster than the economy, and it always causes inflation. I don’t think it’s going to be any different this time.

Investor Optimism Reaching Euphoria

If we see a slowdown in the economy or a steep correction in asset prices, I think it will only accelerate this trend. The Fed will act quickly to calm markets, likely cutting interest rates further, while returning to quantitative easing. It will work like it always does, at least for a while. But monetary stimulus is just another term for future inflation.

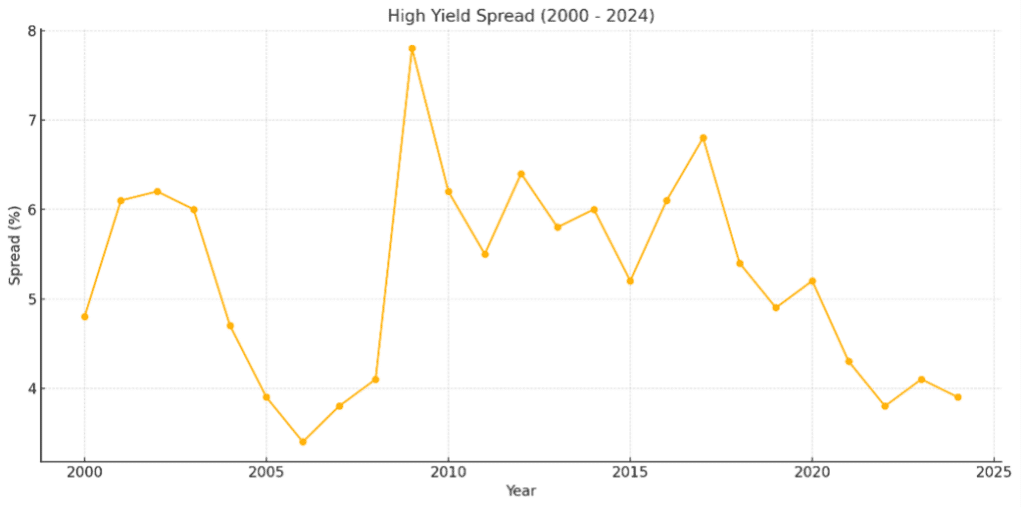

I don’t know if we will see a recession or large correction in 2025, but it would make sense. Asset prices are extremely stretched, and investor optimism is approaching euphoria in equities, crypto, and many fixed income investments. For example, the spread between U.S. Treasuries (risk-free) and high-yield bonds (junk) are now sitting at lows last seen in 2007. Just saying…

Interest Rates

Cost of capital matters to everyone and this could be the biggest challenge for both the economy and asset prices in 2025. The Fed cut rates by 100 basis points in 2024, and the 10-Year Treasury rate seems to be calling the Fed’s bluff as it simultaneously climbed by approximately 100 basis points. While this means higher borrowing costs for businesses and government, it’s likely a signal that the bond market is also predicting higher inflation moving forward.

Fortius Capital’s 2025 Roadmap

Given this backdrop, our approach for the year ahead includes:

- Deepening Tenant Relationships: Maintaining strong tenant relationships is paramount, particularly as we start lease-up of our newly expanded River Dance asset and look to add similar projects.

- Enhanced Operational Efficiencies: Through technology and targeted upgrades, we aim to optimize property performance, reduce costs, and enhance tenant satisfaction.

- Technology Integration: Advances in property technology (PropTech) are transforming all facets of real estate from property management to sourcing new deals and understanding how markets are evolving. Our firm is currently evaluating our entire tech stack and making some critical investments in the technology side of our business.

- Strategic Dispositions and Acquisitions: We will continue to evaluate opportunities to monetize fully valued assets so that we can reinvest in higher potential properties. Our focus remains on value-add opportunities that align with long-term market trends and select development opportunities. Elevated interest rates will likely keep a lid on residential home sales, but that could create some big opportunities for us to acquire struggling projects (e.g., we are looking at a few). We are also monitoring several value-add opportunities, and I think it’s likely a couple of them come to fruition in the first half of 2025.

As always, I’m deeply grateful for your trust and partnership. I know that might sound cliché, but I mean it. I love what I do, and I couldn’t do it without the continued trust and support from our partners, and hope you know how much I appreciate each of you. I look forward to another year of success. Please don’t hesitate to reach out if you’d like to discuss our strategy or opportunities in greater detail.

Here’s to a prosperous and fulfilling 2025!

Best regards,

Mike Pearson

President